Table of Contents

- Executive Summary: Market Dynamics & Key Takeaways

- 2025 Market Landscape: X-ray Geogrid Manufacturing Overview

- Core Technologies: Advances in X-ray Geogrid Production

- Major Players & Industry Collaborations (Sources: tensarcorp.com, acegeosynthetics.com)

- Regional Analysis: Growth Hotspots and Emerging Markets

- Application Trends: Infrastructure, Transportation, and Beyond

- Market Forecast 2025–2029: Revenue and Volume Projections

- Innovation Pipeline: R&D and Next-Generation Geogrids

- Sustainability and Regulatory Developments (Sources: geosyntheticssociety.org)

- Strategic Outlook: Investment, M&A, and Competitive Strategies

- Sources & References

Executive Summary: Market Dynamics & Key Takeaways

The global X-ray geogrid manufacturing sector in 2025 is undergoing significant transformation, driven by advancements in materials science, increased infrastructure investment, and rising environmental standards. X-ray geogrids, an advanced variant of geogrids with enhanced structural analysis enabled by X-ray technologies, are increasingly adopted in critical applications such as road construction, railway embankments, and retaining wall reinforcement. Major manufacturers such as Tenax, Tensar, and NAUE have announced ongoing investments in manufacturing capacity and research to improve the mechanical properties and durability of their X-ray geogrid product lines.

Key dynamics shaping the sector in 2025 include the integration of automated quality control systems and the use of recycled polymers. Companies like BOSTD Geosynthetics are deploying advanced extrusion and weaving technologies that enable more precise control over grid aperture and junction strength, meeting stringent global standards. Additionally, sustainability is at the forefront: leading suppliers are incorporating post-consumer recycled plastics and optimizing manufacturing energy consumption to align with green procurement mandates in Europe and North America.

Demand growth is especially notable in Asia-Pacific and the Middle East, where governments are prioritizing resilient infrastructure in response to climate change and urbanization. According to Geofabrics Australasia, increased adoption of geogrids—including X-ray variants—has been observed in large-scale infrastructure and mining projects throughout Australia and Southeast Asia. The sector is also seeing a shift toward digitalization, with manufacturers integrating real-time data analytics and X-ray inspection systems to ensure product consistency and traceability.

Looking forward, the outlook for X-ray geogrid manufacturing remains robust. Most major players are planning further expansion of their production lines through 2026 and beyond, with continuous innovation in polymer chemistry and manufacturing automation. Regulatory trends—such as stricter requirements for lifespan and traceability—are anticipated to further shape product development. The sector’s agility in responding to these technological and regulatory shifts will remain a key differentiator for market leaders such as Tenax and Tensar.

2025 Market Landscape: X-ray Geogrid Manufacturing Overview

The global X-ray geogrid manufacturing sector in 2025 is characterized by advancing technological integration, increased production capacity, and strategic regional expansions. X-ray geogrids, specialized polymer or composite mesh structures enhanced for radiographic detectability, are gaining traction in infrastructure, mining, and tunneling projects due to their unique safety and monitoring benefits. Leading manufacturers are optimizing extrusion and weaving processes to improve X-ray contrast without compromising mechanical performance.

In 2025, several companies are scaling up their operations to meet the rising demand in transportation and energy sectors. Tenax, a prominent producer of geosynthetic solutions, has announced continued investment in advanced polymer compounding and in-line inspection systems to ensure consistent radiopacity and durability across their geogrid product lines. Similarly, Tensar is focusing on automated quality control technology to enhance traceability and compliance for X-ray detectable geogrids in critical infrastructure applications.

The sector is also witnessing strategic collaborations between raw material suppliers and geogrid manufacturers. Bekaert, known for its expertise in steel and composite reinforcement, has expanded its partnership network to supply specialized radiopaque additives and filaments to geogrid producers, facilitating the customization of geogrids for X-ray-based inspection and asset management.

Regionally, Asia-Pacific remains at the forefront of X-ray geogrid manufacturing growth. Chinese and Indian manufacturers, supported by infrastructure stimulus and government-mandated safety upgrades, are rapidly increasing their production footprints. For instance, Anhui Huate Geosynthetics has introduced new multi-layer geogrid designs explicitly engineered for X-ray detection in underground construction projects, responding to stricter regulatory requirements.

Looking ahead, the outlook for the next few years is optimistic. Investments in research and process innovation are expected to drive further improvements in radiographic visibility, environmental resilience, and installation efficiency. Moreover, with the global emphasis on infrastructure resilience and asset monitoring, adoption of X-ray geogrids is anticipated to expand beyond traditional markets, notably in North America and the Middle East, where NAUE GmbH & Co. KG is actively promoting radiopaque geogrid systems for pipeline and tunnel safety.

Overall, the 2025 market landscape reflects a maturing, innovation-driven sector, with X-ray geogrid manufacturers positioning themselves to address evolving safety, traceability, and performance requirements worldwide.

Core Technologies: Advances in X-ray Geogrid Production

X-ray geogrids represent a significant evolution in the field of geosynthetics, integrating advanced imaging techniques to optimize the structure and performance of grid materials used in civil engineering projects. The year 2025 is poised to see notable advancements in X-ray geogrid manufacturing, driven by increasing infrastructure demands and the push for more resilient construction materials.

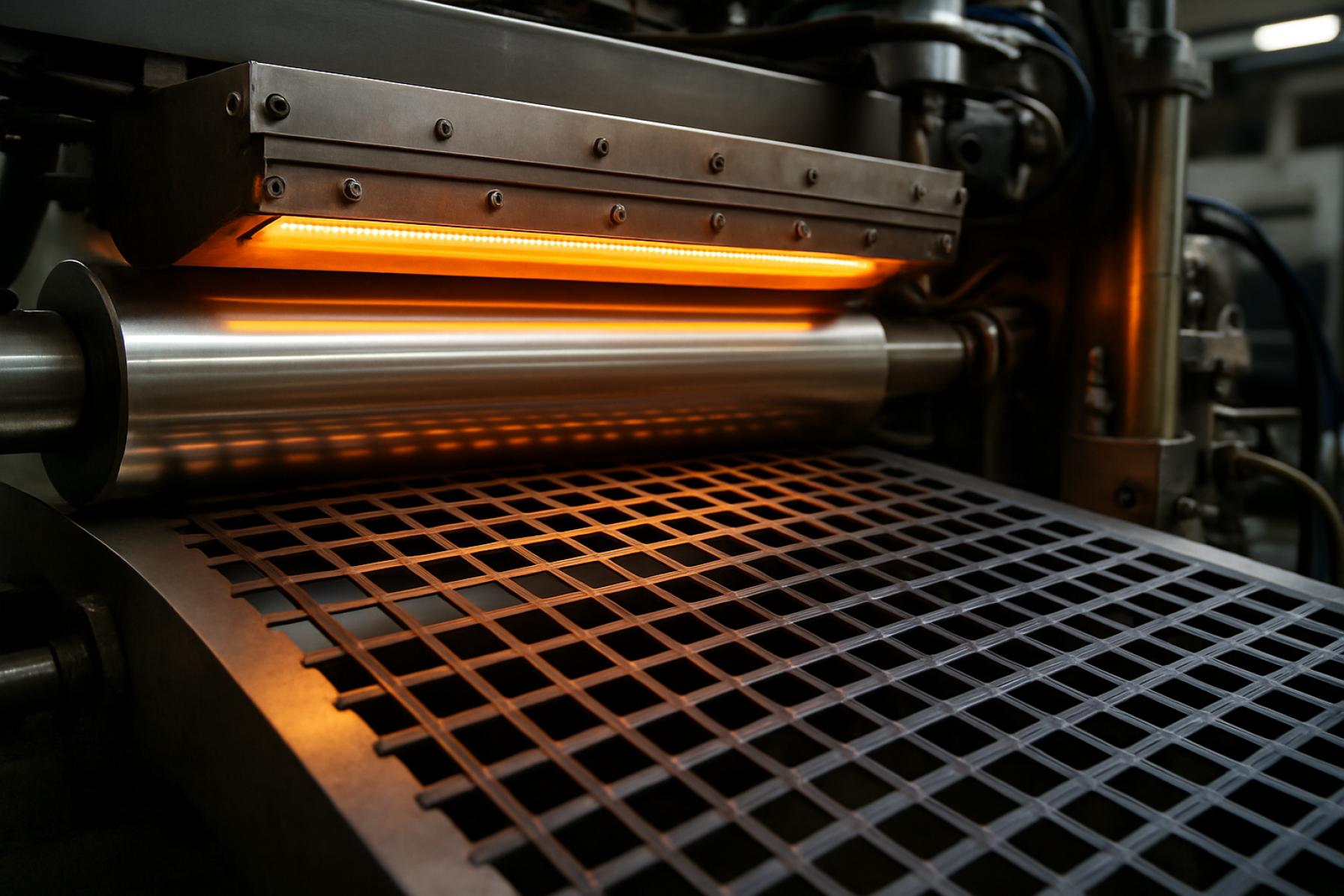

One of the core technological shifts in 2025 involves the adoption of high-precision X-ray imaging during the manufacturing process. This technique allows manufacturers to inspect internal lattice structures in real time, ensuring uniformity, detecting micro-defects, and validating the bonding of polymeric or composite fibers. Companies such as Tenax have highlighted investments in automated inspection systems, which include X-ray based quality control, to enhance their geogrid production lines and maintain high standards of consistency and strength.

Material innovation also plays a pivotal role. Leading suppliers like NAUE GmbH & Co. KG are incorporating advanced polymers and hybrid composite formulations, which are evaluated via X-ray tomography to optimize pore geometry and load-bearing characteristics. This approach enables precise control of the grid’s mechanical properties, directly translating to improved performance in reinforcement applications.

Process automation and digitalization are further accelerating the evolution of X-ray geogrid manufacturing. The integration of machine learning algorithms with X-ray imaging systems enables predictive quality assurance, minimizing waste and downtime. Tensar has reported the deployment of intelligent monitoring systems capable of continuously analyzing production data and making adjustments in real time based on X-ray feedback.

Looking ahead, the industry outlook for the next few years suggests continued investment in X-ray inspection technologies, with a focus on reducing manufacturing costs and increasing scalability. The expansion of smart factories and the use of Industry 4.0 principles are expected to further streamline geogrid production, making high-quality products more accessible for global infrastructure projects. As regulatory requirements evolve and sustainability targets tighten, X-ray-based process validation is likely to become a standard feature among leading geogrid manufacturers.

In summary, 2025 marks a period of rapid technological advancement in X-ray geogrid manufacturing, underpinned by real-time imaging, advanced materials, and data-driven automation. These innovations are set to enhance product quality, operational efficiency, and ultimately the reliability of geogrids in critical construction applications.

Major Players & Industry Collaborations (Sources: tensarcorp.com, acegeosynthetics.com)

The X-ray geogrid manufacturing sector in 2025 is characterized by the active participation of several leading companies and a surge in strategic industry collaborations. Key players such as Tensar Corporation and ACE Geosynthetics continue to drive innovation and expansion in geosynthetic products, including specialized geogrids designed for enhanced material detection and integrity assessment, such as those incorporating X-ray traceability.

As of 2025, Tensar Corporation is focusing on advancing geogrid manufacturing technologies, with particular attention to the integration of quality control mechanisms that utilize X-ray and related imaging methods. These advancements are intended to improve product consistency and performance, especially for critical infrastructure applications where material verification is paramount. The company’s ongoing R&D efforts have resulted in new product lines that meet increasingly stringent regulatory standards and project specifications globally.

Meanwhile, ACE Geosynthetics has announced collaborations with material science firms to further develop geogrids with improved detectability and verification features. These partnerships are fostering the development of multi-functional geogrids that serve both structural and monitoring functions, a trend that is expected to proliferate over the next several years. ACE’s investment in automated manufacturing and non-destructive testing aligns with industry demand for transparency and traceability in infrastructure components.

Industry-wide, collaborations between manufacturers, raw material suppliers, and end-users are intensifying, particularly as infrastructure projects require more robust documentation and quality assurance. Joint initiatives are underway to standardize X-ray inspection protocols and data sharing, enhancing cross-company compatibility and regulatory compliance. These efforts are supported by global infrastructure investment, which is expected to sustain demand for advanced geogrids with embedded monitoring capabilities.

Looking ahead, the outlook for the X-ray geogrid manufacturing sector is positive. Market leaders are poised to benefit from increased adoption of smart construction materials, while new entrants are likely to leverage collaborative research and open innovation to establish a foothold. The next few years will likely see further consolidation among established players and deeper partnerships with technology providers, driving both product performance and manufacturing efficiency.

Regional Analysis: Growth Hotspots and Emerging Markets

The global landscape for X-ray geogrid manufacturing is experiencing a dynamic shift in 2025, with notable growth hotpots and emerging markets driving sector expansion. Traditionally, North America and Europe have dominated the production and application of geogrids, owing to robust infrastructure investments and stringent regulatory standards. However, recent data highlights a significant pivot toward Asia-Pacific and the Middle East, regions where accelerated infrastructure development and urbanization are fueling demand for advanced geosynthetic solutions, including X-ray geogrids.

In the Asia-Pacific region, China remains at the forefront, propelled by large-scale transportation and civil engineering projects under initiatives such as the Belt and Road. Leading manufacturers like HUESKER Synthetic GmbH have expanded their manufacturing footprints and product offerings in response to growing regional demand. India, too, has emerged as a growth hotspot, with government-backed investments in highways, railways, and smart city developments creating fertile ground for geogrid adoption. Indian companies such as Strata Geosystems are increasing production capacity and forging partnerships to address both domestic and export markets.

In the Middle East, infrastructure modernization efforts—especially in Gulf Cooperation Council (GCC) countries—are catalyzing geogrid market growth. Mega-projects in Saudi Arabia, the United Arab Emirates, and Qatar, including transportation corridors and coastal defense systems, are boosting demand for high-performance geosynthetics. TenCate Geosynthetics has reported increased project involvement in the region, leveraging its established global supply chain and technical expertise.

Europe remains a mature market, but the push for sustainable construction practices and rehabilitation of aging infrastructure is generating steady demand for innovative geogrid solutions, including those with advanced X-ray inspection for quality assurance. Companies like NAUE GmbH & Co. KG continue to invest in research and development, targeting both domestic and export opportunities in Eastern Europe and Central Asia.

Looking ahead, the next few years are expected to see intensified competition in emerging markets, with local manufacturers scaling up and established global players increasing investments. The integration of digital manufacturing technologies and stricter quality standards—often verified through X-ray inspection—will likely become key differentiators. As geogrid applications expand beyond traditional road and rail into energy, mining, and environmental reclamation, the regional landscape for X-ray geogrid manufacturing is poised for robust and geographically diversified growth.

Application Trends: Infrastructure, Transportation, and Beyond

In 2025, X-ray geogrid manufacturing is witnessing significant advancements and diversification in its application across infrastructure, transportation, and other sectors. Traditionally, geogrids—integral to soil stabilization, reinforcement, and separation—are finding enhanced utility owing to recent improvements in manufacturing precision and material characterization facilitated by X-ray technology. The adoption of X-ray inspection systems during the production process enables real-time monitoring of fiber orientation, node integrity, and uniformity, ensuring higher product consistency and performance for demanding applications.

Infrastructure projects remain the primary driver for geogrid demand, particularly for road construction, railway embankment reinforcement, and retaining wall stabilization. Major manufacturers such as Tenax and Tensar have reported increasing integration of advanced quality control measures, including X-ray-based inspection, to meet stringent international standards for infrastructure durability and longevity. These technologies help minimize defects and optimize the mechanical properties of geogrids, which is crucial for large-scale highway and railway initiatives currently underway in North America, Europe, and Asia.

In the transportation sector, the need for lightweight yet robust reinforcement materials has prompted greater adoption of X-ray-inspected geogrids for airport runways, port container yards, and transit corridors. Organizations like HUESKER are actively developing innovative product lines that leverage advanced manufacturing controls, including non-destructive X-ray inspection, to cater to these applications. This trend is expected to accelerate as urbanization and infrastructure renewal projects receive increased funding in 2025 and beyond.

Beyond traditional uses, X-ray geogrid manufacturing is expanding into environmental engineering and energy infrastructure. Applications such as landfill capping, erosion control, and the stabilization of renewable energy sites (wind and solar farms) are driving R&D efforts. Companies like NAUE are investing in research collaborations to develop geogrids with enhanced resistance to chemical and UV degradation, verified through X-ray analysis for structural reliability.

Looking forward, the outlook for X-ray geogrid manufacturing is robust. Continuous improvement in X-ray imaging and automation is expected to further enhance product quality and extend geogrid applications into new sectors, such as advanced mining operations and coastal infrastructure. Industry associations, such as the International Geosynthetics Society, are promoting best practices in quality assurance, which increasingly include advanced imaging modalities. As regulatory requirements and performance expectations rise, the integration of X-ray inspection within geogrid manufacturing is set to become a standard for premium products across global markets.

Market Forecast 2025–2029: Revenue and Volume Projections

The X-ray geogrid manufacturing sector is poised for robust expansion from 2025 through 2029, driven by increasing demand across civil engineering, infrastructure reinforcement, and specialized industrial applications. As infrastructure modernization initiatives accelerate worldwide, particularly in Asia-Pacific and North America, the requirement for high-performance geogrids—especially those manufactured with advanced X-ray inspection and quality assurance—continues to rise.

According to Tenax, a major producer of geosynthetic materials, technological advancements in geogrid production are enabling more precise control over grid structure and material performance. The integration of X-ray inspection systems ensures consistent product quality, essential for critical applications in highways, railways, and embankment stabilization.

In 2025, the global X-ray geogrid manufacturing market is projected to achieve steady revenue growth, with volume output expected to surpass previous years as investments in infrastructure projects rebound. Data from NAUE GmbH & Co. KG, a leading geosynthetics manufacturer, indicates that automation and quality control improvements—such as X-ray-based defect detection—are reducing waste and enhancing throughput, supporting higher production volumes at lower costs.

By 2029, industry analysts at Tensar anticipate that the global geogrid market, including X-ray-inspected products, will witness a compound annual growth rate (CAGR) in the high single digits. This growth is underpinned by stricter regulatory standards for construction materials and the growing adoption of smart manufacturing technologies. Companies are increasingly investing in digitalization and advanced inspection systems to meet evolving customer requirements and regulatory demands.

- Revenue is expected to climb steadily, with projections for the X-ray geogrid segment outpacing traditional geogrid manufacturing as quality assurance becomes a key differentiator.

- Volume production is set to increase, aided by automation and more efficient production lines, with leading manufacturers scaling capacity in response to both public and private sector infrastructure spending.

- Regional growth hotspots include China, India, and the United States, where major infrastructure renewal and expansion projects are underway.

With sustained investment in manufacturing innovation and quality control, the X-ray geogrid market is positioned for accelerated growth and heightened competitiveness through 2029. Leading firms such as BOSTD Geosynthetics Qingdao Ltd. are expected to play a pivotal role in setting industry benchmarks for quality and production efficiency.

Innovation Pipeline: R&D and Next-Generation Geogrids

The X-ray geogrid manufacturing sector is witnessing notable advancements in research and development, as industry players prioritize next-generation product innovation to address evolving performance demands in infrastructure, mining, and environmental engineering. In 2025, manufacturers are increasingly focusing on the integration of advanced X-ray inspection and quality control systems directly into geogrid production lines. These systems offer enhanced detection of structural inconsistencies and micro-defects in polymeric and composite geogrids, leading to improved product reliability and lifespan.

Several leading geosynthetics manufacturers are investing in proprietary X-ray imaging technologies to optimize in-line quality assurance. For example, Tenax has highlighted the adoption of real-time X-ray monitoring in pilot-scale production, enabling the early detection of voids or misalignments in high-modulus geogrids during extrusion and stretching processes. Such initiatives are aimed at minimizing waste and ensuring compliance with stringent international standards for civil engineering applications.

In parallel, research laboratories associated with major geogrid suppliers are developing next-generation materials that leverage X-ray computed tomography (CT) for microstructural analysis. This approach provides detailed insights into the internal architecture of novel geogrid formulations, such as those incorporating nano-reinforcements or blended polymers, facilitating data-driven material optimization and design. Tensar, a division of Commercial Metals Company, reports ongoing collaborations with academic institutions to refine X-ray CT protocols for characterizing the long-term durability and fatigue resistance of cutting-edge biaxial and triaxial geogrids.

- In 2025, several pilot projects are underway to automate defect detection and grading using artificial intelligence integrated with X-ray inspection, reducing reliance on manual sampling and post-production testing.

- Emerging standards from organizations like the International Geosynthetics Society are expected to reference X-ray-based metrics for quality certification, reflecting the technology’s growing role in industry-wide best practices.

- Looking ahead, manufacturers anticipate that X-ray-enabled data analytics will accelerate the adoption of custom-designed geogrids for smart infrastructure, as digital twin models incorporate real-time feedback from X-ray inspection data collected during manufacturing.

Overall, the innovation pipeline in X-ray geogrid manufacturing is positioned for rapid evolution over the next few years. With investments in R&D, automation, and digitalization, the sector is likely to deliver increasingly robust, sustainable, and application-specific geogrid solutions for global markets.

Sustainability and Regulatory Developments (Sources: geosyntheticssociety.org)

X-ray geogrid manufacturing in 2025 is experiencing significant shifts driven by escalating sustainability demands and evolving regulatory frameworks. As infrastructure and environmental standards tighten globally, manufacturers are adopting more eco-friendly processes and materials. Notably, the International Geosynthetics Society underscores a trend toward integrating recycled polymers and renewable feedstocks in geogrid production, aiming to reduce lifecycle carbon emissions.

Manufacturers are investing in advanced energy-efficient extrusion technologies and closed-loop water systems to minimize resource consumption and waste generation. For example, leading geosynthetics producers are increasingly publishing sustainability reports outlining reductions in greenhouse gas emissions and resource use, reflecting a broader industry commitment to transparency and continuous improvement. Additionally, the sector sees growing adoption of environmental management systems (EMS) aligned with ISO 14001 standards, further embedding sustainability into core manufacturing operations.

On the regulatory front, 2025 sees stricter environmental compliance requirements across major markets. The European Union’s Circular Economy Action Plan and the U.S. Environmental Protection Agency’s guidelines on polymer use are prompting geogrid manufacturers to enhance product traceability and end-of-life recyclability. New mandates for environmental product declarations (EPDs) are also emerging, particularly for infrastructure projects funded by public agencies. These declarations require detailed documentation of a geogrid’s environmental footprint from raw material sourcing through manufacturing and installation.

Industry bodies such as the International Geosynthetics Society are facilitating collaboration between manufacturers, regulators, and end-users to establish harmonized sustainability metrics and best practices. The society’s ongoing initiatives include the development of standardized testing protocols for recycled-content geogrids and guidance on incorporating circular economy principles into product design and manufacturing.

Looking ahead, X-ray geogrid manufacturers are expected to escalate investment in research and development to meet emerging regulatory thresholds and customer expectations for sustainability. The next several years are likely to bring further innovations in biodegradable and high-performance recycled materials, as well as digital tools for traceability and lifecycle assessment. These trends will continue to shape both product development and market access for X-ray geogrids through the remainder of the decade.

Strategic Outlook: Investment, M&A, and Competitive Strategies

The X-ray geogrid manufacturing sector in 2025 is characterized by dynamic investment flows, strategic mergers and acquisitions (M&A), and intensified competitive positioning as global infrastructure and environmental needs evolve. Geogrids, vital for soil reinforcement and stabilization, are increasingly incorporating advanced technologies such as X-ray inspection for quality assurance, driving innovation and differentiation among leading manufacturers.

In 2025, leading geogrid producers are prioritizing capital expenditure to expand production capacities and integrate cutting-edge quality control systems. Companies like Tensar International Corporation and Officine Maccaferri S.p.A. continue to invest in automation, digital monitoring—including X-ray-based defect detection—and sustainable manufacturing. These investments are intended to meet the rising demand from large-scale infrastructure projects, particularly in Asia-Pacific and North America, where governments are emphasizing resilient and long-lasting construction.

The sector’s strategic landscape is marked by ongoing consolidation. Notably, the 2022 acquisition of Tensar by Commercial Metals Company (CMC) has accelerated vertical integration and resource sharing, strengthening CMC’s geosynthetics portfolio. In the current period, industry observers anticipate that similar M&A activity will persist, with established players targeting niche geogrid specialists or technology-driven startups to enhance their product lines—especially those offering advanced inspection or material science capabilities.

Competitive differentiation in 2025 is increasingly rooted in technological leadership. X-ray inspection systems are becoming a critical feature in the manufacturing process, providing real-time, non-destructive quality assurance that meets stringent regulatory and performance standards. Companies such as NAUE GmbH & Co. KG highlight the integration of automated defect detection and traceability systems to ensure product reliability, which is pivotal for high-stakes civil engineering applications.

Looking ahead, the outlook for X-ray geogrid manufacturing is robust. Strong demand signals from renewable energy infrastructure, transportation, and environmental remediation projects are set to drive further investment. Manufacturers are expected to deepen R&D partnerships, pursue digitalization, and adopt circular economy models—such as recycled polymer feedstocks—to maintain a competitive edge. As regulatory scrutiny and customer expectations around quality intensify, X-ray-enabled geogrid manufacturing is poised to become the industry standard, shaping the sector’s competitive dynamics through the remainder of the decade.

Sources & References

- Tensar

- NAUE

- Tenax

- Bekaert

- TenCate Geosynthetics

- Tenax

- HUESKER

- International Geosynthetics Society

- Commercial Metals Company

- International Geosynthetics Society

- Officine Maccaferri S.p.A.